By adding a gift in your will, you can fund powerful MS research, strengthen caring MS communities, and drive forward vital MS advocacy. Your gift will extend a lifetime of MS support into the future – and the best part is that anyone can make this kind of charitable gift.

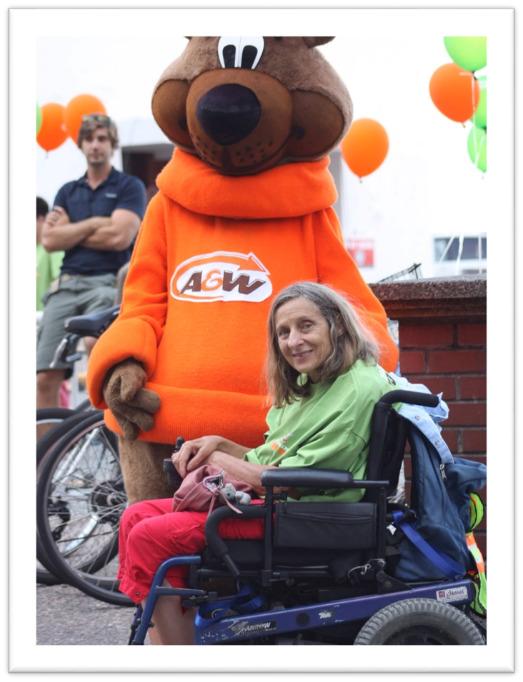

“After talking about it with my sons, I decided to remember MS Canada in my will. My hope is that my gift will help them be there for folks who really need help. And, I was delighted to learn that I can leave a much bigger gift in my will than I could ever give during my lifetime.”

- Linda McGowan, legacy donor

Ways to remember MS Canada in your estate planning

There are many ways to support MS Canada by adding a gift in your will. It’s up to you to choose the type of gift that works for you and your loved ones. You can even ask your lawyer, accountant or financial advisor for their help in creating your estate plan.

Here are a few of the most common types of gifts we receive, to help in your decision-making.

Residual gifts

Leaving a residual gift means leaving a specific percentage of your overall estate to charity. We sometimes think of an estate as a pie, and percentages as slices: for example, you might leave a ‘slice’, or percentage, to each of your children, another slice to your grandchildren, and a slice each to your community hospital, church, and MS Canada. When you make a residual gift, you are donating everything that is left over in your estate after all debt, bills, and taxes have been paid, and loved ones have been provided for. If you’re not certain about the size of your total estate, a residual gift might be a good option!

Fixed gifts

A fixed gift involves making a gift of a specific amount or asset such as real estate, a car, or other property. This is a good option if you feel confident in the size and assets in your estate.

I already have a will. Can I still make a charitable bequest?

If you already have a will, it’s simple to include a bequest to MS Canada with the use of a codicil. Your estate planner can use this small piece of legal text to add a gift to an existing will.

Sample codicil language:

“I direct my Estate Trustee to pay MS Canada the sum of $____________ (or _____% of my estate) to be used for such purposes of MS Canada as its Board of Directors may from time to time determine.”

Have you added MS Canada in your will?

If you’ve added a gift to MS Canada in your estate plans, first and foremost, we’d like to say thank you. Your donation is absolutely vital to creating the future Canadians deserve – a world free of MS!

If you’re comfortable with sharing, we’d love to thank you for your extraordinary generosity, welcome you as a new member of the Evelyn Opal Society and discuss how you’d like MS Canada to continue your legacy of care.

To let us know about your plans to support MS in the years to come, please complete and submit this Statement of Intent form.

Our commitment to you

Adding a gift in a will is a big decision. It is a statement of your values and a reflection of who you are. You can feel confident that every penny is spent to make the greatest impact for people living with MS.

In other words, we promise that your gift will make the greatest impact for Canadians living with MS.

The choice to add a gift in your will may also be an extremely personal one. We encourage you to consult your financial advisors, lawyers, and loved ones as you consider a gift – and of course, we are willing to help you in any way we can.

We're Here to Help You

Whether you have a question about making a gift in your will to MS Canada, or you’d like to let us know of your intentions, we’d be delighted to speak with you.

Please contact Paisley Hill, Manager, Legacy Giving at 1-800-268-7582 or by email at mslegacy@mscanada.ca